For many people superannuation (super) is a problem for tomorrow. Too many people know too little about their super, leave it until later or simply leave their retirement plans to chance. We know you’ve worked hard for your super savings and we want to make sure your savings work even harder for you.

There are many different super fund options available, across a range of product types, giving varying levels of member control and ranges of investment options. When it comes to Self-Managed Super Funds (SMSF), the main difference to other super funds is that SMSF members are also the trustees of the fund. The key advantage of this is the level of control that the trustees have when it comes to tailoring the fund to meet their individual needs.

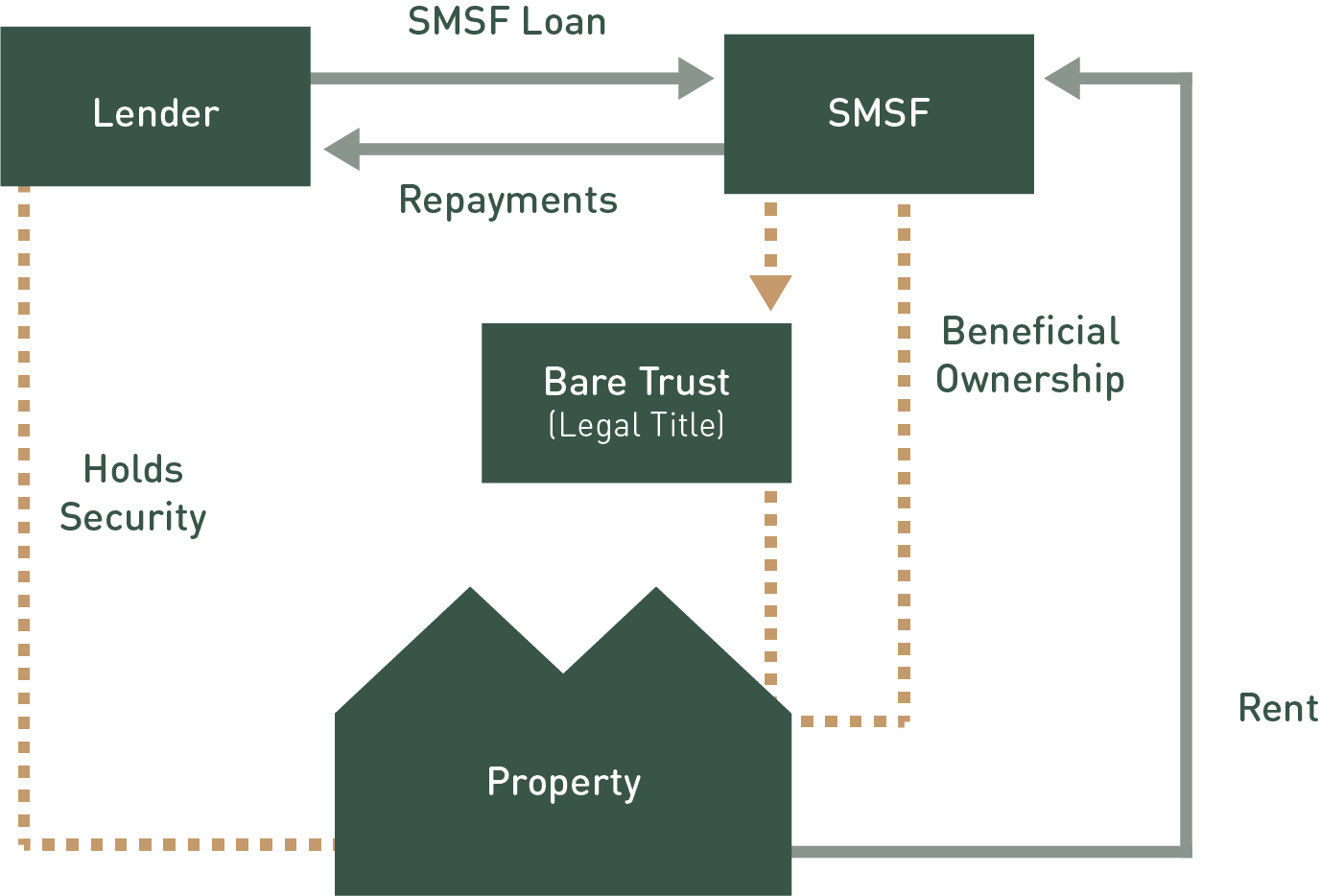

With an SMSF you have control of investment choice, flexibility, transparency, and the ability to capitalise on super specific tax strategies. An SMSF can also pool funds of up to 6 members which could be more cost effective. In addition, an SMSF can take advantage of lending, for larger value growth assets like residential and commercial investment properties.

Naturally, with greater control, also comes greater responsibility. The super industry is tightly regulated to ensure that your superannuation assets are properly protected to provide for your needs in retirement. While you get to make the decisions that will drive your funds’ performance, as trustee of your SMSF you also become responsible for the ongoing management and administration of your super. We recognize than an SMSF is not suitable for everyone, however, with our guidance, we make the journey easier for those trustees who take on the challenge.

No matter how your super is currently structured, our team will work with you to develop the right super strategy for your needs and build an appropriate contribution strategy to enhance your retirement plans.