For many property investors, listening to the outcome of the RBA’s monthly meetings has become a horror show. When the market expected the RBA to pause its rate rising, they delivered their twelfth interest rate rise, now they have paused rates, but the rhetoric is suggesting there may be another 2 more rate rises to come. So, what does this mean for property investors?

Negative gearing for property investors

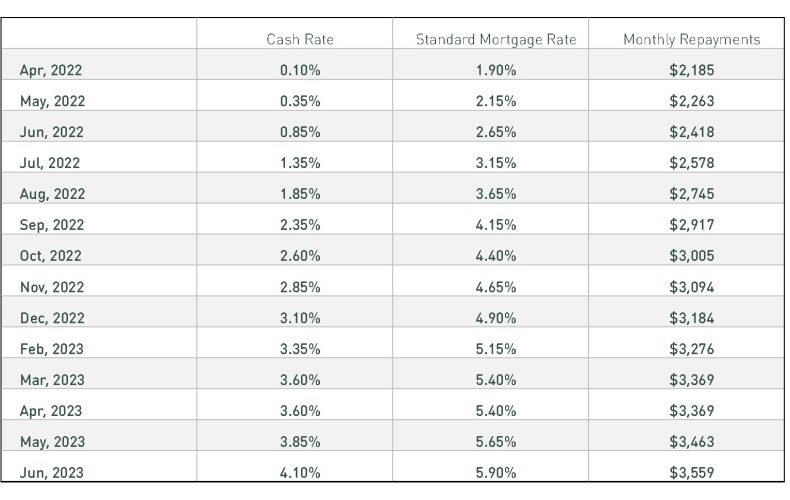

The obvious implication for mortgagees is higher monthly interest payments. As shown above, after the RBA’s latest cash rate rise to 4.1%, a property owner with a $600,000 mortgage is now facing monthly repayments of $3,559. It’s a rare investment property that is generating enough rent to cover such hefty monthly repayments in addition to all the other costs of property ownership. In other words, more property investors are now negatively geared after the RBA’s recent rate rises.

Potential economic challenges and inflation concerns

Most economists agree the RBA’s actions have significantly increased the risk of a challenging economic landing without necessarily addressing the arch-nemesis, inflation. The reason for this is that interest rates tend to impact demand rather than supply, whereas inflation is currently being mainly driven by supply constraints, generally at a global level. Hence, the RBA’s rate raising strategy may be causing Australian economic pain without solving the problem it’s targeting.

Balancing higher ownership costs and strong demand

In theory, there should be a negative impact on property valuations since property investors face significantly higher ownership costs than a year ago. However, the property market continues to struggle with demand growth which exceeds supply growth. With the return of significant net immigration numbers, this dynamic is expected to continue in the foreseeable future. This is likely to protect the property market from the negative impacts of the RBA’s rate raising.

So what’s a property investor to do in the face of these rate-related challenges?

Landen’s Head of Lending, Ashik Rahman, has some valuable and timely advice to offer: ‘The RBA is certainly keeping property investors on their toes. Like most industry experts, we’re surprised by the extent and speed of this interest rate raising cycle. It’s already the swiftest round of interest rate rises in Australian history. Beyond empathising with all mortgagees out there, our best advice for property owners is to repay as much debt as possible to enable you to ride out this cycle without being forced to sell your property at the wrong time. We think values will continue to grow over time, so stay focused on your long term financial goals.’

If you need assistance managing your mortgage, contact our Lending specialists on 1300 526 336 for a consultation, or enquire now and we will get back to you shortly.